SAN FRANCISCO—On Wednesday, June 3, Varo Money, a mobile banking service based in San Francisco, announced that it has secured $241 million in its fifth round of investments.

With the newest addition, Varo totals over $419 million in investor funds. This round of investments was led by The Rise Fund, which has been a Varo investor since early 2018 and is also headquartered in San Francisco, along with the private investment company Gallatin Point Capital, a new investor for Varo. The company also brought on other new investors including the private equity firm HarbourVest Partners and the insurance company Progressive.

Maya Chorengel, co-managing partner at The Rise Fund, told the San Francisco News, “[The Rise Fund] invested in Varo because its mission-focused management team has embedded positive social impact into the company’s founding principles, core product and its business model.”

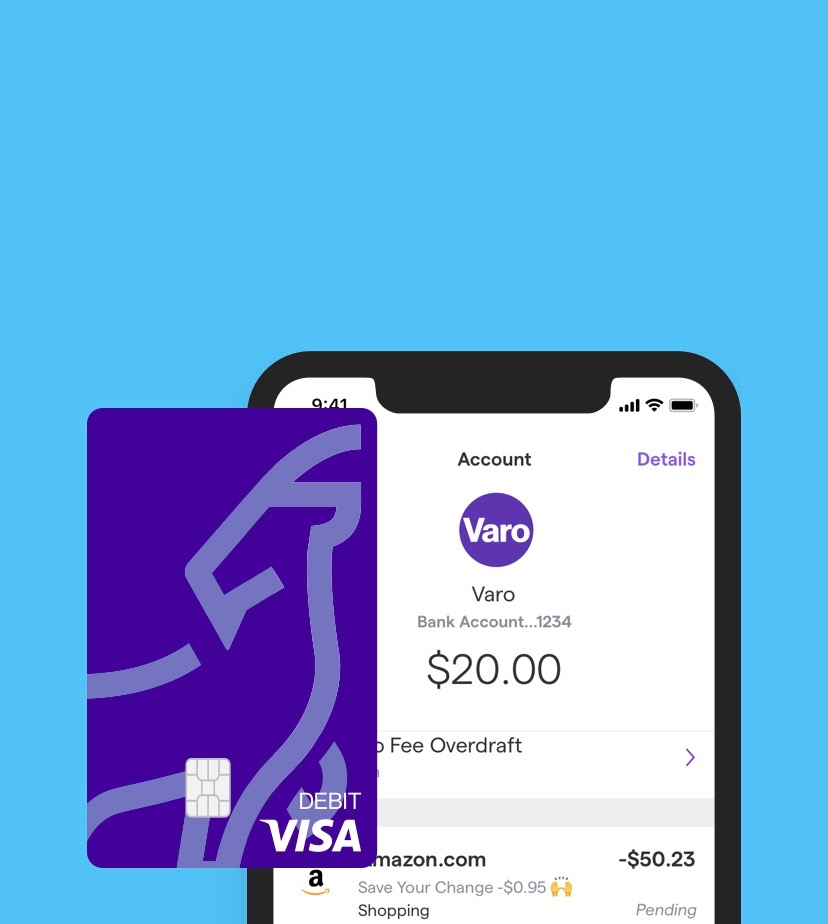

Varo was founded in July 2017 by CEO Colin Walsh and CTO Kolya Klymenko. According to Walsh, since then it has accumulated nearly two million banking and savings accounts.

The mobile bank service is currently in the final stages of securing a national charter in order to become the first fully digital national bank—a goal that this $241 million will help advance, as Walsh stated in a press release.

Varo expects to receive approval for the national charter sometime in the summer after it satisfies certain conditions of the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), and the Federal Reserve.

Amid COVID-19, Varo has continued to grow. As Walsh noted in an email interview with the San Francisco News, the company has seen “a significant uptick” since the start of 2020. Over the period from January 2020 to now, Varo’s account growth has increased by 60 percent, deposits have more than tripled, and spending has nearly doubled.

Varo has taken several steps in response to the COVID-19 pandemic. It increased its deposit and ATM limits in order for customers to receive full stimulus packages and to promote shelter-in-place orders by minimizing the need for customers to visit the ATM.

The company has also put a renewed emphasis on the app’s “Offers” tab, looking to specifically feature companies that provide work opportunities for its customers who have faced employment obstacles due to the pandemic. In addition to its partnership with Steady, a mobile application where users can find hourly, on-demand work, it is also working with Wonolo, an online staffing platform.

According to Walsh, the $241 million in funding will be channeled toward new products like short-term lending, as well as credit building and repairing solutions that will aid customers who have been financially impacted by the coronavirus pandemic. The money will also go toward the development of Varo’s national bank.

Varo promotes a mission of making “a powerful impact on systemic financial inequality in communities across this country,” Walsh said in the news release. Their bank accounts have no minimum balance requirements and no monthly account fees.

As Walsh told the San Francisco News, “America needs a bank that recognizes the decades of financial inequality and chooses to do something about it, and that has always been and continues to be Varo’s mission.”