SAN FRANCISCO—San Francisco was one of four cities to approve Proposition V —a tax on sugary beverages, also known as the “soda tax” on Tuesday, November 8 with over 62 percent voting in favor of the proposition. Opponents of Proposition V have have nicknamed it the “grocery tax” because of the belief that it will increase costs for grocers. The tax will directly affect the soda distribution companies and not the stores that carry the sugary drinks, the SF Examiner reported.

The Verge reported that the tax will be placed on beverages that contain an added calorie sweetener and that have more than 25 calories in 12 ounces. Some of the beverages directly affected include soda, energy drinks, sports drinks, and sweetened teas, according to reports. A similar soda tax was proposed in 2014, but failed in San Francisco and passed in Berkeley, CA.

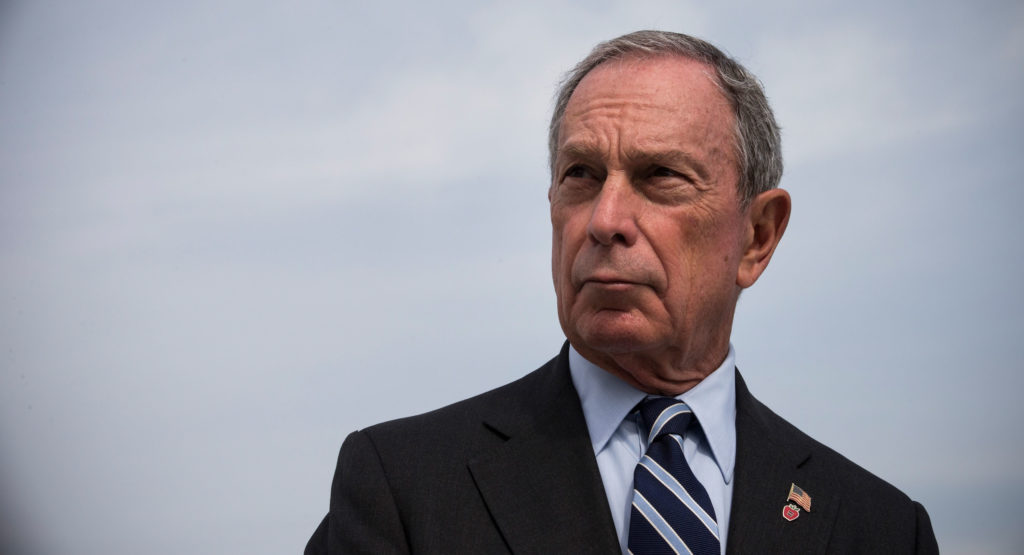

One advocate for the soda tax has been former New York City Mayor Michael Bloomberg. Bloomberg invested $18 million in the soda-tax—with $9.1 of that investment directly funded to the proponents of Proposition V in San Francisco, according to reports. Proponents in favor of the tax is hoping to decrease the negative impacts on American’s health.

“This is an astonishing repudiation of big soda. For too long, the big soda companies got away with putting profits over their customers’ health,” said Jim Krieger, Executive Director of Healthy Food America.

The World Health Organization (WHO) has attributed soda as one of the primary causes to obesity and diabetes.

“They provide no nutritional value with their calories and their consumption is by now convincingly linked to poor diets and poor health outcomes. In the United States, sales of sugary sodas have been declining for the last decade, largely in response to targeted health advocacy,” states the WHO website.

Opponents argue that the tax unfairly targets soda, as a primary pawn in the fight against obesity and diabetes in the United States. Some criticized the new tax for forcing grocers to potentially increase prices to meet the change in costs. It could have a negative effect on lower-income families indicated Fox News in a report.

The American Beverage Association has spent millions of dollars against the soda tax. These ideas have been supported by Supervisor Jane Kim and American Beverage Association’s consultant, Joe Arellano.

“I would rather subsidize healthy food than tax soda,” stated Kim in an interview with the SF Examiner.

Ben Rosenfield, a Controller of the proposition wrote in a statement to the Department of Elections:

“it [Proposition V] would result in an annual tax revenue increase to the City of approximately $7.5 million in fiscal year (FY) 2017-2018 and $15 million in FY 2018-19.”

The funds according to Rosenfield would be deposited into the General Fund. He adds that a Sugary Drinks Distributor Tax Advisory Committee would be put in place to advise the Mayor and the Board of Supervisors on the impact of the tax-including an annual report beginning of 2018 with details on concerns such as beverage prices, consumer behavior, and pubic health.